Recording Transactions

Debits and Credits

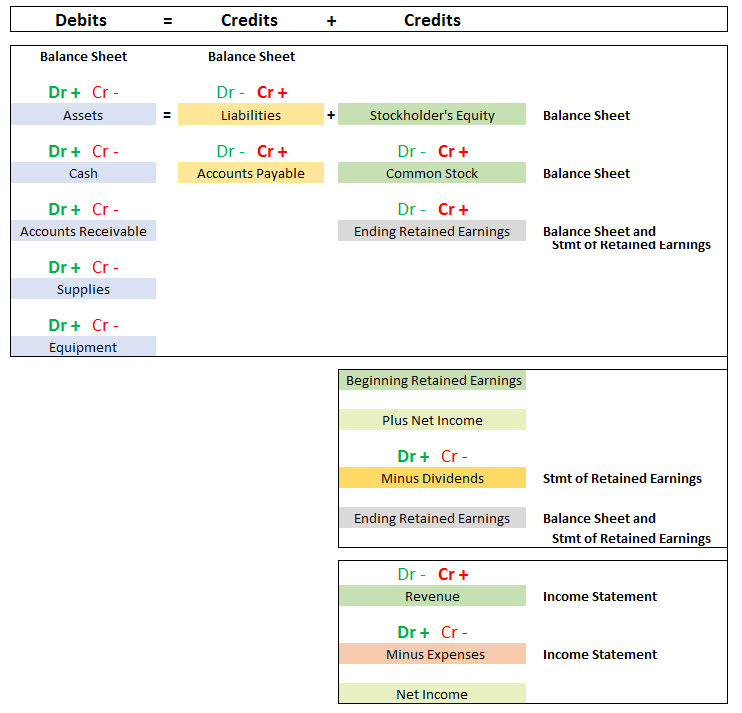

The hardest part is determining which account gets debited and which one gets credited. To learn, we will use an updated expanded accounting equation.

The general format – Assets are the left or debit side of the equation and liabilities and stockholder’s equity is on the right or credit side of the equation. Thus, assets increase with a debit and liabilities/equity increase with a credit.

We can see the rules for assets and liabilities are the same (so far). These rules generally hold true, when an asset increases, it is debited and when it decreases, it is credited. When a liability increases, it is credited and when it decreases it is debited. When shareholder equity increases through sales of common stock or income, these sub-equity accounts are credited and when it decreases through paying dividends or expenses, these sub-equity accounts are debited. Retained earnings record the effects of what transpires in the revenue, expenses and dividends accounts. The total effect of all sub-equity accounts increase or decrease equity in total.

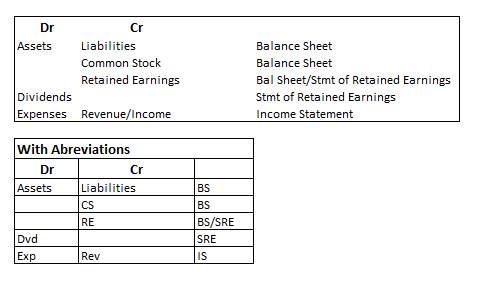

Shortened (easy to memorize) debits and credits chart with financial statement info – Legal cheat sheet – Normal Balances for Accounts

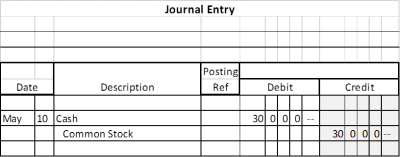

Recording journal entries in the general journal

The general journal is a diary of each day’s transactions in order and is a complete record of every transaction in one place. The process of recording transactions in a journal is called journalizing.

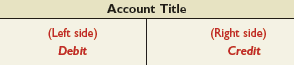

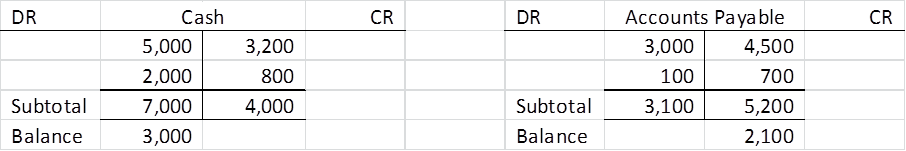

Post the transaction in the general ledger (We will use T accounts)

The general ledger, or simply ledger, is a record containing all the individual accounts used by a company. All cash transactions are housed in one place. All the accounts payable transactions are housed in one place, etc. We will use T accounts to simulate the general ledger. A T-account represents a ledger account and is a tool used to understand the effects of one or more transactions.

The layout of a T-account is (1) the account title on top, (2) a left, or debit side, and (3) a right, or credit, side.

Think of debit and credit as accounting directions for left and right.

The left side of an account is called the debit side, often abbreviated Dr. The right side is called the credit side, abbreviated Cr. To enter amounts on the left side of an account is to debit the account. To enter amounts on the right side is to credit the account.

The T-Account

The difference between total debits and total credits for an account, including any beginning balance, is the account balance.

To balance a T account, always do the same three steps

- Add up all the debits

- Add up all the credits

- Take the smaller from the larger. The result will either be a debit or a credit balance. When the sum of debits equals the sum of credits, the account has a zero balance.

Important concept – Normal balance

Accounting has its own lingo and to differentiate between an account that looks “normal” and one that may indicate problems, the term “normal” balance is used. If an account (asset) increases with a debit, its normal balance is a debit balance and if an account (accounts payable) increases with a credit, its normal balance is a credit balance.

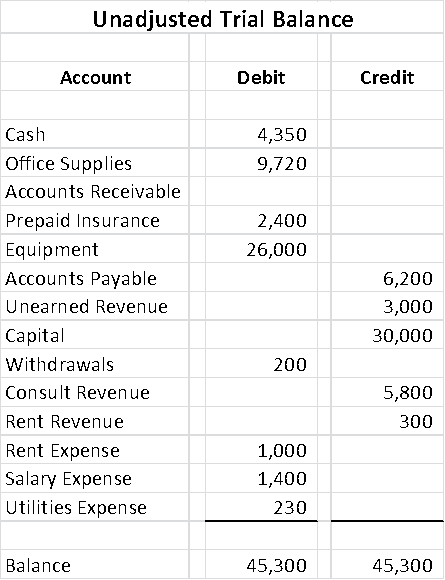

Prepare the unadjusted trial balance to determine if records are in balance and look normal

The next step is to summarize all the accounts and their balances to determine if the balances are normal and the amounts are expected. This summarization is done with an unadjusted trial balance.

Double-entry accounting requires the sum of debits to equal the sum of credit account balances. A trial balance is used to confirm this by listing all accounts and their balances and will be used to follow up on any abnormal or unusual balances.

You Tube Video – Recording and Posting Journal Entries as well as Unadjusted Trial Balance