Adjusting Accounts, Preparing Financial Statements, and Closing the Books

ADJUSTING ACCOUNTS

Adjusting entries are necessary so that revenues, expenses, assets, and liabilities are correctly reported. Specifically, an adjusting entry is made at the end of an accounting period to reflect a transaction or event that is not yet recorded. Each adjusting entry affects one or more income statement accounts and one or more balance sheet accounts (but never the Cash account).

Prepaid Expenses

Prepaid expenses refer to items paid for in advance of receiving their benefits. When these assets are used, their costs become expenses.

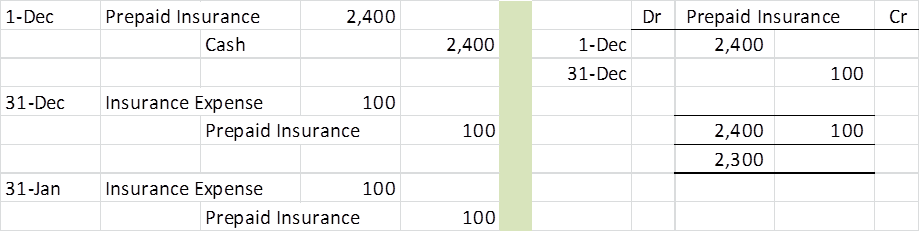

In our chapter example, prepaid insurance is equal to its $2,400 payment for 24 months of insurance benefits that began on December 1, 2011.

With the passage of time, the benefits of the insurance gradually expire and a portion of the Prepaid Insurance asset becomes expense. For instance, one month’s insurance coverage expires by December 31, 2011. This expense is $100, or 1/24 of $2,400, which leaves $2,300.

The adjusting entry to record this expense and reduce the asset, along with T-account postings

Office Supplies

Supplies are an asset which will be used up over time. This usage creates an expense to be matched against the revenues they helped to generate.

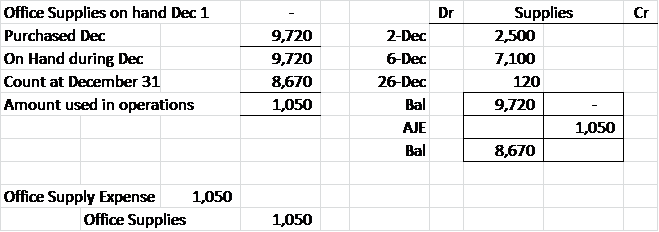

In our chapter example, the company purchased $9,720 of supplies in December and some of them were used during this month. When financial statements are prepared at December 31, the cost of supplies used during December must be recognized.

When the company computes (takes physical count of) its remaining unused supplies at December 31, it finds $8,670 of supplies remaining of the $9,720 total supplies. The $1,050 difference between these two amounts is December’s supplies expense.

The adjusting entry to record this expense and reduce the Supplies asset account, along with T-account postings

Depreciation

Plant assets refers to long-term tangible assets used to produce and sell products and services. Plant assets are expected to provide benefits for more than one period. Examples of plant assets are buildings, machines, vehicles, and fixtures.

Depreciation is the process of allocating the costs of these assets over their expected useful lives. Depreciation expense is recorded with an adjusting entry.

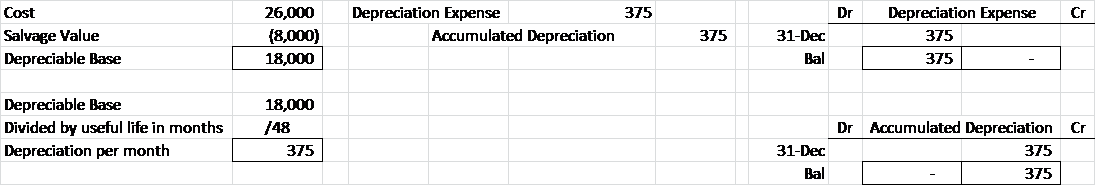

Equipment was purchased for $26,000 in early December to use in earning revenue. This equipment’s cost must be depreciated.

The equipment is expected to have a useful life (benefit period) of four years and to be worth about $8,000 at the end of four years.

The company uses a method called straight-line depreciation, which allocates equal amounts of the asset’s net cost to depreciation during its useful life.

The adjusting entry to record monthly depreciation expense, along with T-account postings

Accumulated depreciation is kept in a separate contra account. A contra account is an account linked with another account, where the contra account has a normal balance opposite of the account it is linked with. It is reported as a subtraction from that other account’s balance. This account will “accumulate” depreciation until either fully depreciated or the asset is removed from the books.

The contra account of Accumulated Depreciation — Equipment is subtracted from the Equipment account in the balance sheet. This contra account allows balance sheet readers to know both the full costs of assets and the total accumulated depreciation.

The title of the contra account, Accumulated Depreciation, reveals that this account includes total depreciation expense for all prior periods for which the asset was used.

Unearned (Deferred) Revenues

The term unearned revenues refers to cash received in advance of providing products and services. Unearned revenues are liabilities. When cash is accepted, an obligation to provide products or services is accepted. As products or services are provided, the unearned revenues become earned revenues. Adjusting entries for unearned revenues involve increasing revenues and decreasing unearned revenues

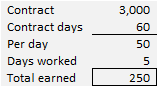

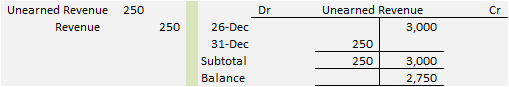

The company received $3,000 on Dec 26 in advance for consulting work to be done over the next sixty days. The company is now obligated to perform the consulting work or pay back the money back.

![]()

As time passes and work is done, the company earns this payment through consulting. By December 31, it has provided five days’ service.

Revenue recognition principle implies that $250 of unearned revenue must be reported as revenue on the December income statement.

The adjusting entry to reduce the liability account and recognize earned revenue, along with T-account postings, follows:

Accruals – Heretofore, we have adjusted accounts and amounts already in existence but accruals reflect necessary adjustments that have not yet been recorded.

Accrued expenses. Costs such as wages, interest, utilities that have not yet been recorded but are known and due. Each has helped the company to earn revenue. They have been incurred but not yet paid.

Accrued Salaries Expense

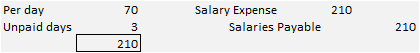

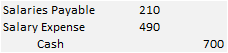

Supposed an employee earns $70 per day. A company must record wage expense for all employees from the last payroll to the date of the financial statements. Thus, if an employee has worked three days since last payroll and the financial statements are prepared as of Dec 31, then

Salaries Payable is recorded on the balance sheet and the related salary expense is recorded on the income statement.

This is the Hard Part – Since the AJE created a liability, it must be taken into consideration when the salaries are paid subsequently.

Accrued Revenues – Shown for illustration purposes but not in homework or on test.

The term accrued revenues refers to revenues earned in a period that are both unrecorded and not yet received in cash (or other assets).

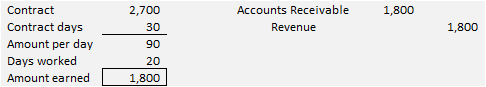

If a company earns a portion of the income associated with a contract, companies often recognize the amount earned but not yet paid. If there is a $2,700 contract for 30 days and the company has worked on it for 20 days, then

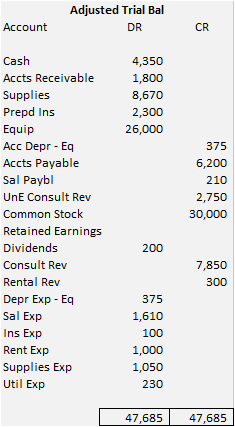

Adjusted Trial Balance

An unadjusted trial balance is a list of accounts and balances prepared before adjustments are recorded. An adjusted trial balance is a list of accounts and balances prepared after adjusting entries have been recorded and posted to the ledger.

The order of accounts in the trial balance is usually set up to match the order in the chart of accounts. Several new accounts arise from the adjusting entries.

CLOSING PROCESS

The closing process is an important step at the end of an accounting period after financial statements have been completed. It prepares accounts for recording the transactions and the events of the next period. The process updates retained earnings for income earned, expenses, and dividends. These accounts will be zeroed out to prepare them to accumulate new information.

Revenue, Expense and Dividend accounts (Inc Stmt and Stmt of RE accounts) are temporary accounts which accumulate data related to one accounting period. They are temporary because the accounts are opened at the beginning of a period, used to record transactions and events for that period, and then closed at the end of the period. The closing process applies only to temporary accounts.

Balance Sheet accounts are permanent accounts report on activities related to one or more future accounting periods. They carry their ending balances into the next period and consist of all balance sheet accounts. These asset, liability, and equity accounts (common stock and retained earnings) are not closed.

Steps to close the nominal or temporary accounts

We will use a new temporary account “Income Summary” to close the income statement accounts (Revenues and Expenses). It will then be closed as well.

- Debit all revenue accounts and credit Income Summary (Total up all of these debits and credit Income Summary with the total amount of debits)

- Credit all expense accounts and debit Income Summary (Total up all of these credits and debit Income Summary with the total amount of credits)

- Balance the income summary account in a T Account form

- Deduct the smaller amount from the larger amount

- If it is a credit (normal) balance, then debit Income Summary for this amount and credit Owner’s Capital for the same amount.

- If it is a debit balance (loss), then credit Income Summary for this amount and debit Owner’s Capital for the same amount.

- Deduct the smaller amount from the larger amount

- Credit the Dividend account for the balance in the account and debit Retained Earnings for the same amount.

- Prepare the post-closing trial balance, only balance sheet accounts (permanent) accounts should be on the post-closing trial balance. There should be no balances in withdrawals, revenue or expense accounts.

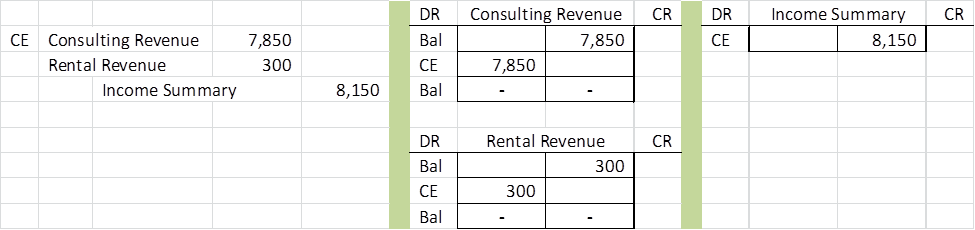

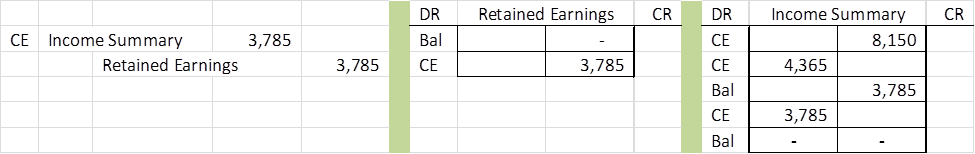

An Example: The Closing Process

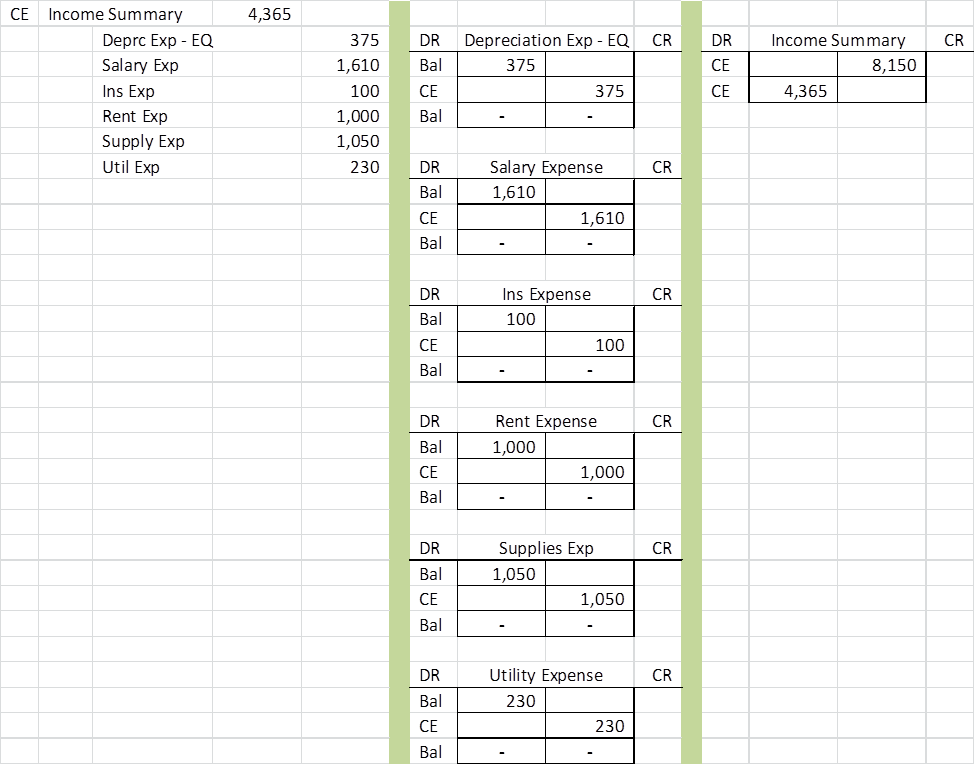

The closing process uses an account entitled “income summary” to aid in the in the closing process. It is only used during this process. Steps in the closing process:

- Debit all revenue accounts and credit income summary.

- Credit all expense accounts and debit income summary

- Balance the income summary account and close it out to Retained Earnings

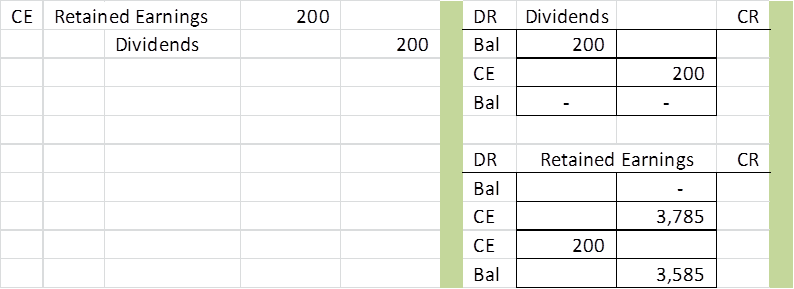

- Close out the Dividends account to Retained Earnings

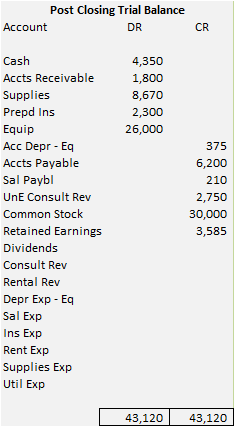

Post-Closing Trial Balance – The following shows all accounts after the closing process

A post-closing trial balance is a list of permanent accounts—all accounts not closed. The aim of a post-closing trial balance is to verify that (1) total debits equal total credits for permanent accounts and (2) all temporary accounts have zero balances.

You Tube Video – Adjusting and Closing Entries

You Tube Video – Silent Version – Corporation Accounting Cycle