Managerial Accounting: An Overview

Management accountants are strategic business partners who understand the financial and operational sides of the business. They not only report and analyze financial measures, but also nonfinancial measures of process performance and corporate social performance.

(1) What is managerial accounting? and (2) Why does managerial accounting matter to your career?

What Is Managerial Accounting?

You have already completed an introductory financial accounting course. Financial accounting is concerned with reporting financial information to external parties, such as stockholders, creditors, and regulators. Managerial accounting is concerned with providing information to internal managers for use within the organization.

Financial accounting serves the needs of those outside the organization, whereas managerial accounting serves the needs of managers employed inside the organization. Because of this fundamental difference in users, financial accounting emphasizes the financial consequences of past activities, objectivity and verifiability, precision, and companywide performance, whereas managerial accounting emphasizes decisions affecting the future, relevance, timeliness, and segment performance.

A segment is a part or activity of an organization about which managers would like cost, revenue, or profit data. Examples of business segments include product lines, customer groups (segmented by age, ethnicity, gender, volume of purchases, etc.), geographic territories, divisions, plants, and departments.

Finally, financial accounting is mandatory for external reports and it needs to comply with rules, such as generally accepted accounting principles (GAAP) and international financial reporting standards (IFRS), whereas managerial accounting is not mandatory and it does not need to comply with externally imposed rules.

Managerial accounting helps managers perform three vital activities—planning, controlling, and decision making.

Planning involves establishing goals and specifying how to achieve them.

Controlling involves gathering feedback to ensure that the plan is being properly executed or modified as circumstances change.

Decision making involves selecting a course of action from competing alternatives.

Planning – The Budget

Plans are often accompanied by a budget. A budget is a detailed plan for the future that is usually expressed in formal quantitative terms.

Controlling – Budget Analysis – Flexible Budgeting, Standard Costs and Performance Measurement

This process would involve gathering, evaluating, and responding to feedback to ensure the budget meets expectations. It would also include evaluating the feedback in search of ways to be more effective.

The goal would be to go beyond simple yes or no answers in search of the underlying reasons why performance exceeded or failed to meet expectations. Part of the control process includes preparing performance reports. A performance report compares budgeted data to actual data in an effort to identify and learn from excellent performance and to identify and eliminate sources of unsatisfactory performance. Performance reports can also be used as one of many inputs to help evaluate and reward employees.

Decision Making – Cost Volume Profit concepts, Segment Analysis, Differential Analysis

Perhaps the most basic managerial skill is the ability to make intelligent, data-driven decisions. Broadly speaking, many of those decisions revolve around the following three questions. What should we be selling? Who should we be serving? How should we execute?

There are three pillars of managerial accounting a–planning, controlling, and decision making. This book helps prepare you to become an effective cost accountant and/or manager by explaining how to make intelligent data-driven decisions, how to create financial plans for the future, and how to continually make progress toward achieving goals by obtaining, evaluating, and responding to feedback.

Manufacturing Accounting.

Additionally, we will cover how to account for a manufacturing business through Job Order Costing, Process Costing and ABC costing.

Why Does Managerial Accounting Matter to Your Career?

What can you do now to prepare for success in an unknown future career? The best answer is to learn skills that will make it easier for you to adapt to an uncertain future. You need to become adaptable!

Business Majors

Whether you end up working in the United States or abroad, for a large corporation, a small entrepreneurial company, a nonprofit organization, or a governmental entity, you’ll need to know how to plan for the future, how to make progress toward achieving goals, and how to make intelligent decisions. In other words, managerial accounting skills are useful in just about any career, organization, and industry. If you commit energy to this course, you’ll be making a smart investment in your future—even though you cannot clearly envision it.

You will obtain most of your decision making information from a cost accounting who works alongside you to gather information for a decision. You need to understand their processes because you alone will go into a meeting to advocate for a course of action.

Accounting Majors

Many accounting graduates begin their careers working for public accounting firms that provide a variety of valuable services for their clients. Some of these graduates will build successful and fulfilling careers in the public accounting industry; however, most will leave public accounting at some point to work in other organizations. In fact, the Institute of Management Accountants (IMA) estimates that more than 80% of professional accountants in the United States work in nonpublic accounting environments

The public accounting profession has a strong financial accounting orientation. Its most important function is to protect investors and other external parties by assuring them that companies are reporting historical financial results that comply with applicable accounting rules.

Managerial accountants also have strong financial accounting skills. For example, they play an important role in helping their organizations design and maintain financial reporting systems that generate reliable financial disclosures. However, the primary role of managerial accountants is to partner with their co-workers within the organization to improve performance.

If you are an accounting major there is a very high likelihood that your future will involve working for a nonpublic accounting employer. Your employer will expect you to have strong financial accounting skills, but more importantly, it will expect you to help improve organizational performance by applying the planning, controlling, and decision-making skills that are the foundation of managerial accounting. Additionally, you will be successful if you can explain cost accounting concepts to a variety of different personnel with an organization from every facet of the company.

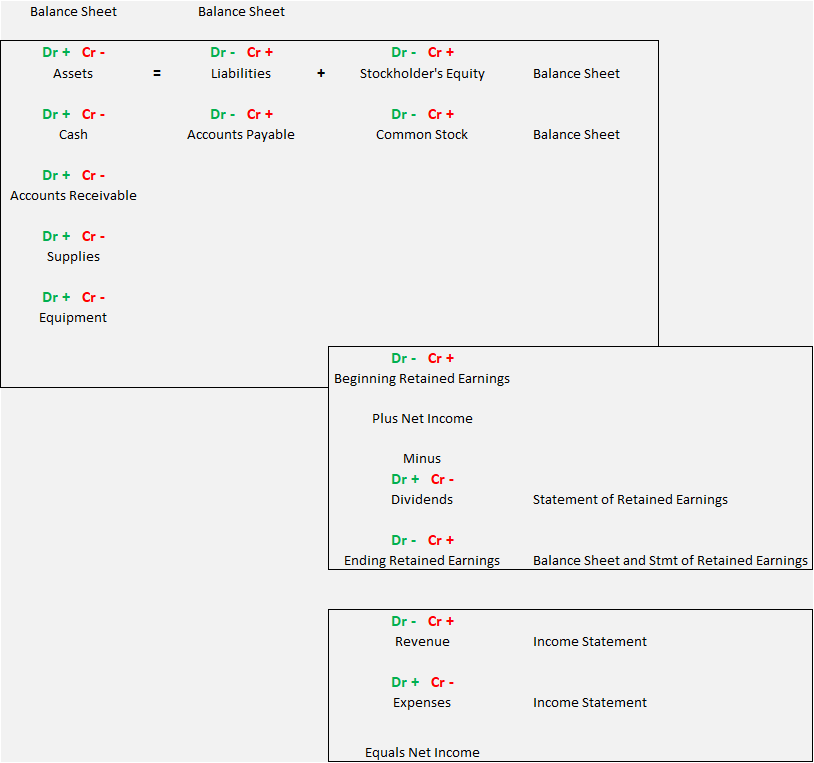

Basic Corporate Accounting Structure