Introduction to Accounting

The Basic Accounting Equation

Assets represent resources a company has that will provide future services or benefits, i.e. usually more than a month or so. If a company pays for its insurance every six months, it has an asset. If a company pays for its insurance every month, it has incurred an expense. They are many different types of assets, such as cash, accounts receivable, supplies, equipment, etc. There are various specific GAAP rules associated with the accounting treatment for each.

Liabilities represent what a company owes. The obligations can be short term such as accounts payable or salaries payable or long-term such as a lease or a loan. When you owe money to another party (vendor) on a short-term basis for the purchase of supplies, it is called “accounts payable.” When someone owes you money (customer) on a short-term basis it is an asset called “accounts receivable.”

All of those to whom a company owes money are its creditors. These come first in the accounting equation, because they must be paid first before the owners can receive anything if a company were to be liquidated.

Shareholder Equity represents accumulation of shareholders’ wealth. There are four (4) different types of shareholders’ equity accounts that affect equity. Common stock, dividends, revenue/income, and expenses.

Sales of common stock represent infusions of cash to the company—increase shareholder equity. Dividends paid to shareholders decrease shareholder equity. Income from operation increases equity. Expenses from operations decrease equity.

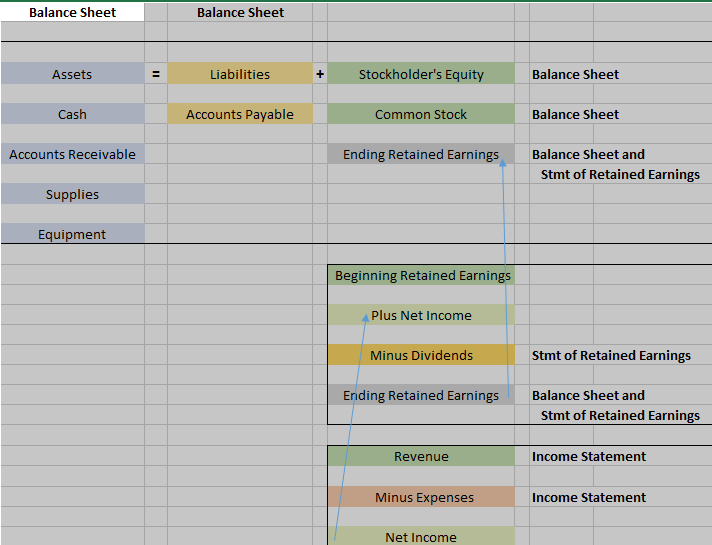

Expanded Accounting Equation and Financial Statements

There are four financial statements and they are prepared in a specific order.

- Income Statement – Statement of income and expenses from company operations which yields either net income or a net loss. Net income/loss is then recorded in the Statement of Retained Earnings.

- Statement of Retained Earnings – Starts with beginning retained earnings and then adds net income from the income statement minus dividends, yielding the ending balance in retained earnings.

- Balance Sheet – Listing of Assets, Liabilities, Common Stock and the ending balance of Retained Earnings

- Statement of Cash Flows – How cash was obtained and spent

How Do Accounting Transactions Affect the Accounting Equation?

Link to You Tube Video on Expanded Accounting Equation and Financial Statements