This lecture consists of lecture notes, a narrated presentation, and in class assignments.

Cash Over and Short.

Differences between the count of the cash in a cash register and the record from the register of cash receipts yield cash over and short journal entries. Cash Over and Short is an income statement account recording the income effects of cash overages and cash shortages. Cash Over and Short account usually is combined with other miscellaneous expenses on the income statement.

To record cash over and short, follow these simple rules:

- Record the cash count as a debit to Cash (Physically how much cash the company has)

- Record the cash register record as a credit to Sales (Theoretically how much cash the company should have from the cash register report)

- The difference will be either a debit or a credit to Cash Over and Short

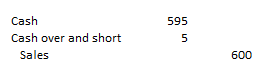

If a cash register’s record shows $600 should be in the register but the cash count from the register is $595, the journal entry is:

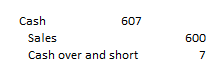

If a cash register’s record shows $600 should be in the register but the cash count from the register is $607, the journal entry is:

Bank Reconciliation

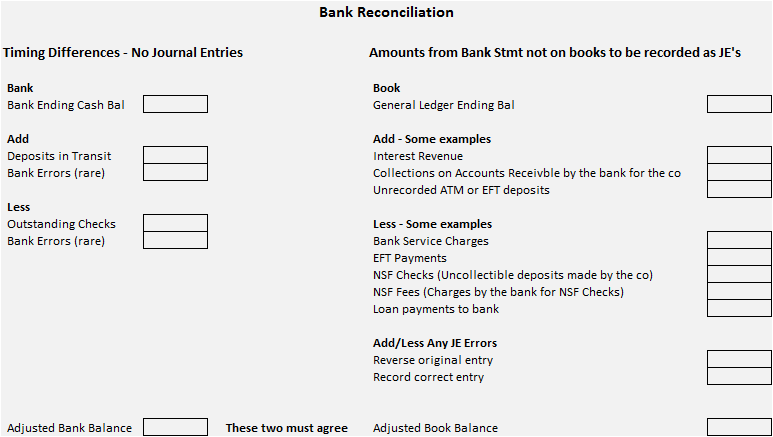

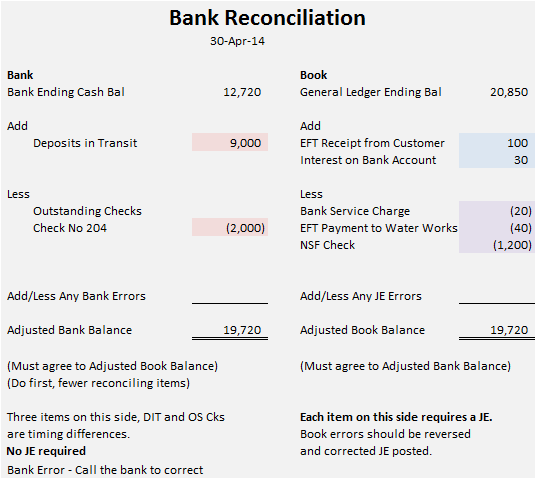

The balance of a checking account reported on the bank statement rarely equals the general ledger cash balance in the accounting records. There are timing difference between the bank and the general ledger because the bank is not up to date with amounts in the general ledger. There are amounts on the books of the company that will not be recorded until the bank statement arrives.

Bank Side

In preparing a bank reconciliation, always reconcile the bank side (left side below) first because there are generally only two reconciling items – deposits in transits (deposits not yet recorded by the bank but recorded in the general ledger) and outstanding checks (checks written and recorded by the company but not yet received by the bank). The ending Adjusted Bank Balance will help you determine if you have properly recognized all reconciling items from the book or right-hand side. NOTE: Deposits in Transit, Outstanding Checks and Bank Errors do not require a journal entry.

The ending Adjusted Bank Balance must agree to the ending Adjusted Book Balance.

Book or General Ledger Side

Reconciling items on the book side. These will come from the bank statement. Each will require a journal entry.

Add: Any interest received, any collections from your customers which the bank has performed on behalf of the company, and any previously unrecorded deposits.

Subtract: Any bank service charges, EFT payments, insufficient funds (NSF) checks you deposited, any fees for NSF checks, and any loan payments to the bank. (This is not an exhaustive list but a review of the bank statement will show what has been deducted from the bank account).

Journal Entry Errors: 1) Reverse the original entry as though it did not happen (easier to explain and also to remember) and 2) Record the proper amount.

Cash and Petty Cash Lecture Narrated by Prof Chauvin