Recording Transactions

ANALYZING AND RECORDING PROCESS

The accounting process identifies transactions, records them and then communicates those results in financial statements. It is also concerned with analyzing the effect of all transactions on the business.

Business transactions and events are the starting points. Relying on source documents, these transactions are recorded in the accounting books, or simply the books.

Steps to recording transactions in the books

- Review source documents

- Review the chart of accounts to determine what accounts are affected. (The chart of accounts is a listing of all available accounts)

- Determine whether the accounts are increasing or decreasing

- Record the transaction in the general journal – Recording journal entries. The general journal is a chronological listing of all recorded transactions—much like a person’s journal. This is when an account is either debited or credited.

- Post the journal entries in the general ledger (We will use T accounts)

- Prepare the unadjusted trial balance to determine if records are in balance and look normal

Debits and Credits

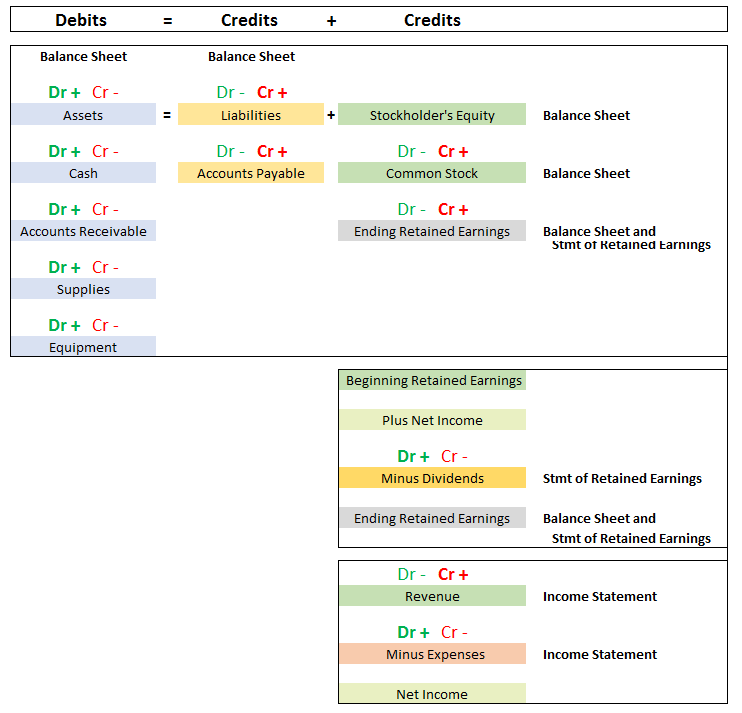

The hardest part is determining which account gets debited and which one gets credited. To learn, we will use an updated expanded accounting equation.

Think of debit and credit as accounting directions for left and right.

The left side of an account is called the debit side, often abbreviated Dr. The right side is called the credit side, abbreviated Cr. To enter amounts on the left side of an account is to debit the account. To enter amounts on the right side is to credit the account.

The general format – Assets are the left or debit side of the equation and liabilities and stockholder’s equity is on the right or credit side of the equation. Thus, assets increase with a debit and liabilities/equity increase with a credit.

We can see the rules for assets and liabilities are the same (so far). These rules generally hold true, when an asset increases, it is debited and when it decreases, it is credited. When a liability increases, it is credited and when it decreases it is debited. When shareholder equity increases through sales of common stock or income, these sub-equity accounts are credited and when it decreases through paying dividends or expenses, these sub-equity accounts are debited. Retained earnings record the effects of what transpires in the revenue, expenses and dividends accounts. The total effect of all sub-equity accounts increase or decrease equity in total.

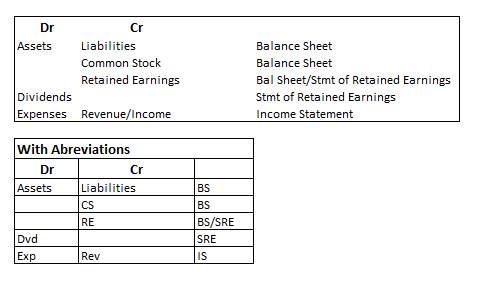

Shortened (easy to memorize) debits and credits chart with financial statement info – Legal cheat sheet – Normal Balances for Accounts

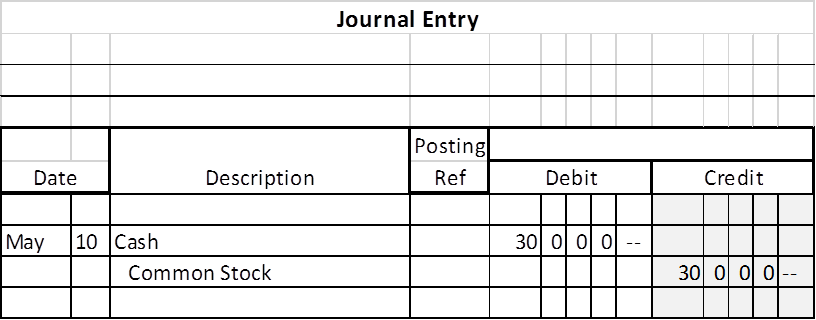

Recording journal entries in the general journal

The general journal is a diary of each day’s transactions in order and is a complete record of every transaction in one place. The process of recording transactions in a journal is called journalizing. The below journal entry records a debit and credit in the amount of $30,000. The thousands are in the larger space to the left, hundreds in the three lined columns, and cents are in the larger space to the right.

To record:

- Determine the accounts affected by the transaction.

- Date the transaction. (We may number transactions in class to save time but this is the proper procedure).

- First, enter account(s) to be debited and then enter amounts in the debit column. The entry is aligned to the left margin of the description column. The debit always goes first.

- Enter accounts(s) to be credited and then enter amounts in the credit column. The account name is indented from the left margin to distinguish them from debited accounts.

- Enter a brief explanation below or reference the source document. (We will not do in class to save time but this is proper procedure).

- There must be at least one debit and one credit. The total debits must equal the total credits for the journal entry.

Post the transaction in the general ledger (We will use T accounts)

The general ledger, or simply ledger, is a record containing all the individual accounts used by a company. For example, all cash transactions are housed in one place. All the accounts payable transactions are housed in one place, etc. We will use T accounts to simulate the general ledger. A T-account represents a ledger account and is a tool used to understand the effects of one or more transactions.

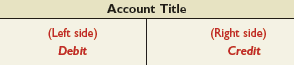

The layout of a T-account is (1) the account title on top, (2) a left, or debit side, and (3) a right, or credit, side.

Think of debit and credit as accounting directions for left and right.

The left side of an account is called the debit side, often abbreviated Dr. The right side is called the credit side, abbreviated Cr. To enter amounts on the left side of an account is to debit the account. To enter amounts on the right side is to credit the account.

Do not make the error of thinking that the terms debit and credit mean increase or decrease. Whether a debit or a credit is an increase or decrease depends on the account. (Use your accounting equation sheet to help you memorize the debits and credits for each account until you understand the system.)

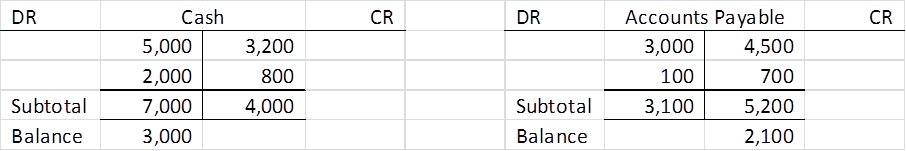

The T-Account

The difference between total debits and total credits for an account, including any beginning balance, is the account balance.

To balance a T account, always do the same three steps

- Add up all the debits

- Add up all the credits

- Take the smaller from the larger. The result will either be a debit or a credit balance. When the sum of debits equals the sum of credits, the account has a zero balance.

Important concept – Normal balance

Accounting has its own lingo and to differentiate between an account that looks “normal” and one that may indicate problems, the term “normal” balance is used. If an account (asset) increases with a debit, its normal balance is a debit balance and if an account (accounts payable) increases with a credit, its normal balance is a credit balance.

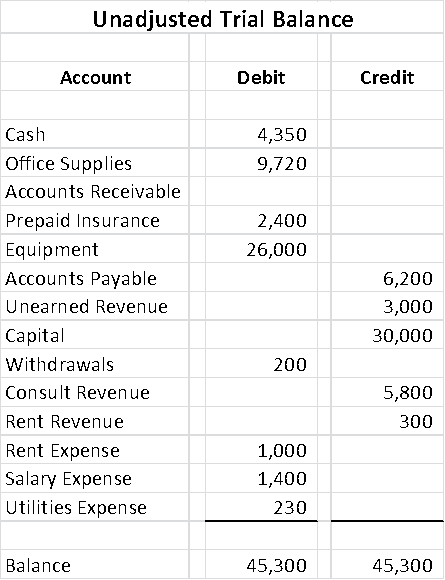

Prepare the unadjusted trial balance to determine if records are in balance and look normal

The next step is to summarize all the accounts and their balances to determine if the balances are normal and the amounts are expected. This summarization is done with an unadjusted trial balance.

Double-entry accounting requires the sum of debits to equal the sum of credit account balances. A trial balance is used to confirm this by listing all accounts and their balances and will be used to follow up on any abnormal or unusual balances.

Preparing a trial balance involves three steps:

- List each account title and its amount (from ledger) in the trial balance. If an account has a zero balance, list it with a zero in its normal balance column.

- Add the total of debit balances and the total of credit balances.

- Determine total debit balances equal total credit balances.

Using a Trial Balance to Prepare Financial Statements

The trial balance can then be used to prepare the financial statements. Note: The Income Statement and Statement of Retained Earnings are for a period of time such as the month ended, the quarter ended or the year ended. The Balance Sheet is as of a specific date—the amounts are valid on that date only.

Account Descriptions.

Asset Accounts Assets are resources owned or controlled by a company, and those resources have expected future benefits.

Cash account reflects a company’s cash balance.

Accounts receivable result from credit sales or sales on account (or on credit) from a customer. Accounts receivable are increased by credit sales and are decreased by customer payments. One company will record an accounts receivable and the other company which is a party to the transaction will record an accounts payable.

Prepaid accounts (prepaid expenses) are assets that will benefit future periods not just the current month. Examples: prepaid insurance, prepaid rent, and prepaid services (such as Saints season tickets). Prepaid accounts expire with the passage of time (such as with rent) or through use (such as with prepaid meal tickets). One company will record a prepaid account, and the company receiving the money will record unearned revenue until it is earned through time or use.

Supplies are assets until they are used. When they are used up, their costs are reported as expenses.

Equipment is an asset. The cost of equipment is systematically and rationally allocated to expense by matching it to the revenue it helped generate.

Liability Accounts Liabilities are claims (by creditors) against assets, which means they are obligations to transfer assets or provide products or services to others. Creditors are individuals and organizations that have rights to receive payments from a company.

Accounts payable refer to oral or credit purchases of supplies, equipment, and services. One company will record an accounts payable, and the other company which is a party to the transaction will record an accounts receivable.

Note payable refers to a formal promise, usually denoted by the signing of a promissory note, to pay a future amount. Note: if one company has a note payable, another company has a note receivable.

Unearned revenue refers to cash a company receives in advance of providing services such as concert tickets, football season tickets, retainers for lawyers, etc. When customers pay in advance for products or services (before revenue is earned), the revenue recognition principle requires that the seller consider this payment as unearned revenue. When products and services are later delivered, the earned portion of the unearned revenue is transferred to revenue accounts. Note: if one company has unearned revenue, the other company which is a party to the transaction has a prepaid expense.

Accrued liabilities are amounts owed that are not yet paid. Examples are wages payable, taxes payable, and interest payable. Amounts are reasonably estimable.

Equity Accounts The owner’s claim on a company’s assets is called equity, or stockholders’ equity, or shareholders’ equity.

Common Stock – When an owner invests in a company in exchange for common stock, the invested amount is recorded in an account titled Common Stock. Any further owner investments are recorded in this account. This holds true for sales to the public of common stock.

Dividends: When the company pays any cash dividends, it decreases both the company’s assets and its total equity. Dividends are not expenses of the business. They are simply the opposite of owner investments.

Revenues and expenses also impact equity.

Revenue accounts are Sales, Commissions Earned, Professional Fees Earned, Rent Revenue, and Interest Revenue. Result from products and services provided to customers.

Expense accounts are Advertising Expense, Store Supplies Expense, Office Salaries Expense, Office Supplies Expense, Rent Expense, Utilities Expense, and Insurance Expense. Result from assets and services used in a company’s operations.