Adjusting Accounts, Preparing Financial Statements, and Closing the Books

Underlying GAAP Considerations

Time Period Assumption

The time period assumption presumes the company can adequately prepare its financial statements when its accounting periods are divided into months or years. Timely information is paramount to good decisions. Additionally, owners periodically want to know the exact amount of their wealth accumulation.

Accrual basis of accounting

GAAP requires companies to match expenses to revenue. And revenue to be recognized when earned. Thus, when the books must be closed as of a specific date, all expenses and revenues must be brought up to date. The updating of expenses and revenue flow from internal transactions which remain unrecorded until the books are “adjusted.” These internal transactions are called “adjusting journal entries” and are therefore different form journal entries which flow from external transactions.

Recognizing Revenues and Expenses

The revenue recognition principle requires that revenue be recorded when earned. Most companies earn revenue when they provide services and products to customers. A major goal of the adjusting process is recognize revenue in the time period when it is earned.

The expense recognition (or matching) principle aims to record expenses in the same accounting period as the revenues that are earned as a result of those expenses. This matching of expenses with the revenue benefits is a major part of the adjusting process.

Adjusting Journal Entries

We will learn about six adjustments

- Prepaid expenses

- Supplies

- Depreciation

- Unearned revenue

- Accrued expenses

- Accrued revenues

ADJUSTING ACCOUNTS – Adjusting Journal Entries

Adjusting entries are necessary so that revenues, expenses, assets, and liabilities are correctly reported. Specifically, an adjusting entry is made at the end of an accounting period to reflect a internal transaction or event that is not yet recorded. Each adjusting entry affects one or more income statement accounts and one or more balance sheet accounts (but never the Cash account).

Prepaid Expenses

Prepaid expenses refer to items paid for in advance of receiving their benefits. When these assets are used, their costs become expenses. One company will record a prepaid expense, and the company receiving the money will record unearned revenue.

Office Supplies

Supplies are an asset which will be used up over time. This usage creates an expense to be matched against the revenues they helped to generate.

Depreciation

Plant assets refers to long-term tangible assets used to produce and sell products and services. Plant assets are expected to provide benefits for more than one period. Examples of plant assets are buildings, machines, vehicles, and fixtures.

Depreciation is the process of allocating the costs of these assets over their expected useful lives. Depreciation expense is recorded with an adjusting entry.

Unearned (Deferred) Revenues

The term unearned revenues refers to cash received in advance of providing products and services. Unearned revenues are liabilities. When cash is accepted, an obligation to provide products or services is accepted. As products or services are provided, the unearned revenues become earned revenues. Adjusting entries for unearned revenues involve increasing revenues and decreasing unearned revenues. The company receiving the money records unearned revenues, and the other company which was party to the transaction records a prepaid expense.

Accruals – Heretofore, we have adjusted accounts and amounts already in existence but accruals reflect necessary adjustments that have not yet been recorded.

Accrued expenses. Costs such as wages, interest, utilities which have not yet been recorded but are known and due. Each has helped the company to earn revenue. They have been incurred but not yet paid.

Accrued Salaries Expense

Suppose an employee earns $70 per day. A company must record wage expense for all employees from the last payroll to the date of the financial statements. Thus, if an employee has worked three (3) days since last payroll and the financial statements are prepared as of Dec 31, then the expense must be accrued for these three (3) days.

Accrued Revenues – Shown for illustration purposes but not in homework or on test. The term accrued revenues refers to revenues earned in a period that are both unrecorded and not yet received in cash (or other assets). I prefer to use the conservative approach which does not recognize revenue until billed.

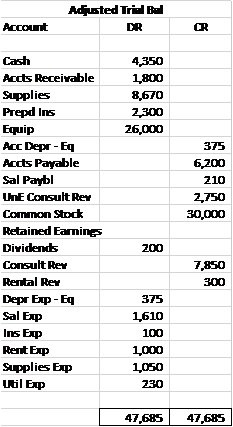

Adjusted Trial Balance

An unadjusted trial balance is a list of accounts and balances prepared before adjustments are recorded. An adjusted trial balance is a list of accounts and balances prepared after adjusting entries have been recorded and posted to the ledger.

The order of accounts in the trial balance is usually set up to match the order in the chart of accounts. Several new accounts arise from the adjusting entries.

PREPARING FINANCIAL STATEMENTS

We can prepare financial statements directly from information in the adjusted trial balance. An adjusted trial balance includes all accounts and balances in the financial statements and is easier to work from than the entire ledger when preparing financial statements.

We prepare financial statements in the following order: Income Statement, Statement of Retained Earnings, and Balance Sheet. The Income Statement information is needed in the Statement of Retained Earnings. The information from the Statement of Retained Earnings is used to prepare the Balance Sheet.

CLOSING PROCESS

The closing process is an important step at the end of an accounting period after financial statements have been completed. The financial statements have been prepared and now journal entries called “closing” entries are needed to sync the books up with the financial statements. The closing process prepares accounts for recording the transactions and the events of the next period. The process updates retained earnings for revenue, expenses, and dividends. These accounts will be zeroed out to prepare them to accumulate new information for owner’s wealth. These accounts (revenues, expenses and dividends) are sub retained earnings accounts which segregate information on the accumulation of owner’s wealth.

Revenue, Expense and Dividend accounts (Inc Stmt and Stmt of RE accounts) are temporary accounts and accumulate data related to one accounting period. They are temporary because the accounts are opened at the beginning of a period, used to record transactions and events for that period, and then closed at the end of the period. The closing process applies only to temporary accounts.

Balance Sheet accounts are permanent accounts report on activities related to one or more future accounting periods. They carry their ending balances into the next period and consist of all balance sheet accounts. These asset, liability, and equity accounts (common stock and retained earnings) are not closed. These balances continue in existence after the balance sheet date.

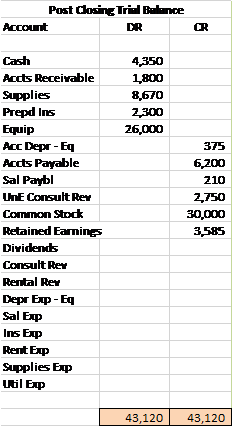

Post-Closing Trial Balance

A post-closing trial balance is a list of permanent accounts—all accounts not closed. The aim of a post-closing trial balance is to verify that (1) total debits equal total credits for permanent accounts and (2) all temporary accounts have zero balances.

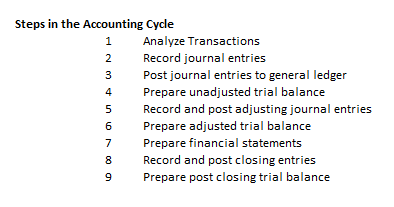

Accounting Cycle Steps

The term accounting cycle refers to the steps in preparing financial statements. It is called a cycle because the steps are repeated each reporting period.

CLASSIFIED BALANCE SHEET

An unclassified balance sheet is one whose accounts are broadly grouped into assets, liabilities, and equity. A classified balance sheet organizes assets and liabilities into important liquidity subgroups that provide more information to decision makers. Assets and Liabilities are grouped as either current (realized in less than a year) or long-term (realized in more than a year). Current is defined as either the company’s operating cycle (usually a day) or a year whichever is longer. An operating cycle is the time period between when a company acquires goods and services for sale and then is paid for their goods and services. We assume a year operating cycle in this class.

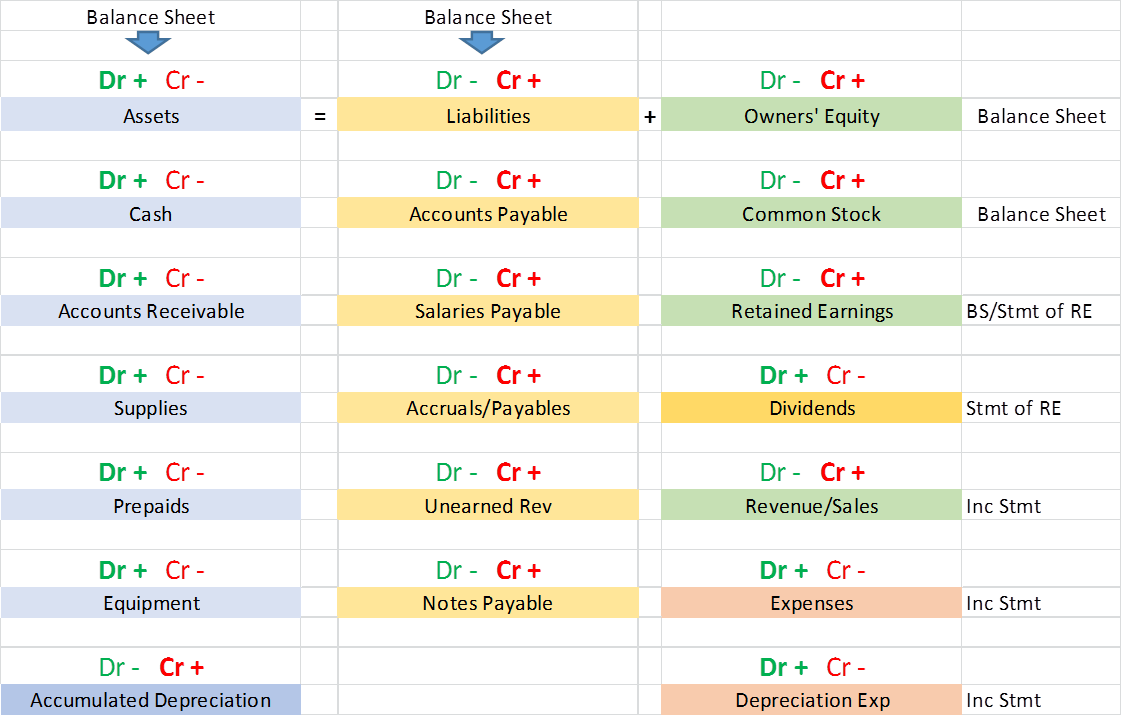

New Accounting Equation for Chapter 3